The National Tax and Customs Office -DIAN regulates the use of the electronic signatures

The National Tax and Customs Office- DIAN issued Resolution 0070 dated November 3, 2016 whereby all individuals holding digital signatures must migrate to the new Instrument of Electronic Signature, henceforth -IFE- (Instrumento de Firma Electrónica) that will work with the identification of the user and the use of two special passwords.

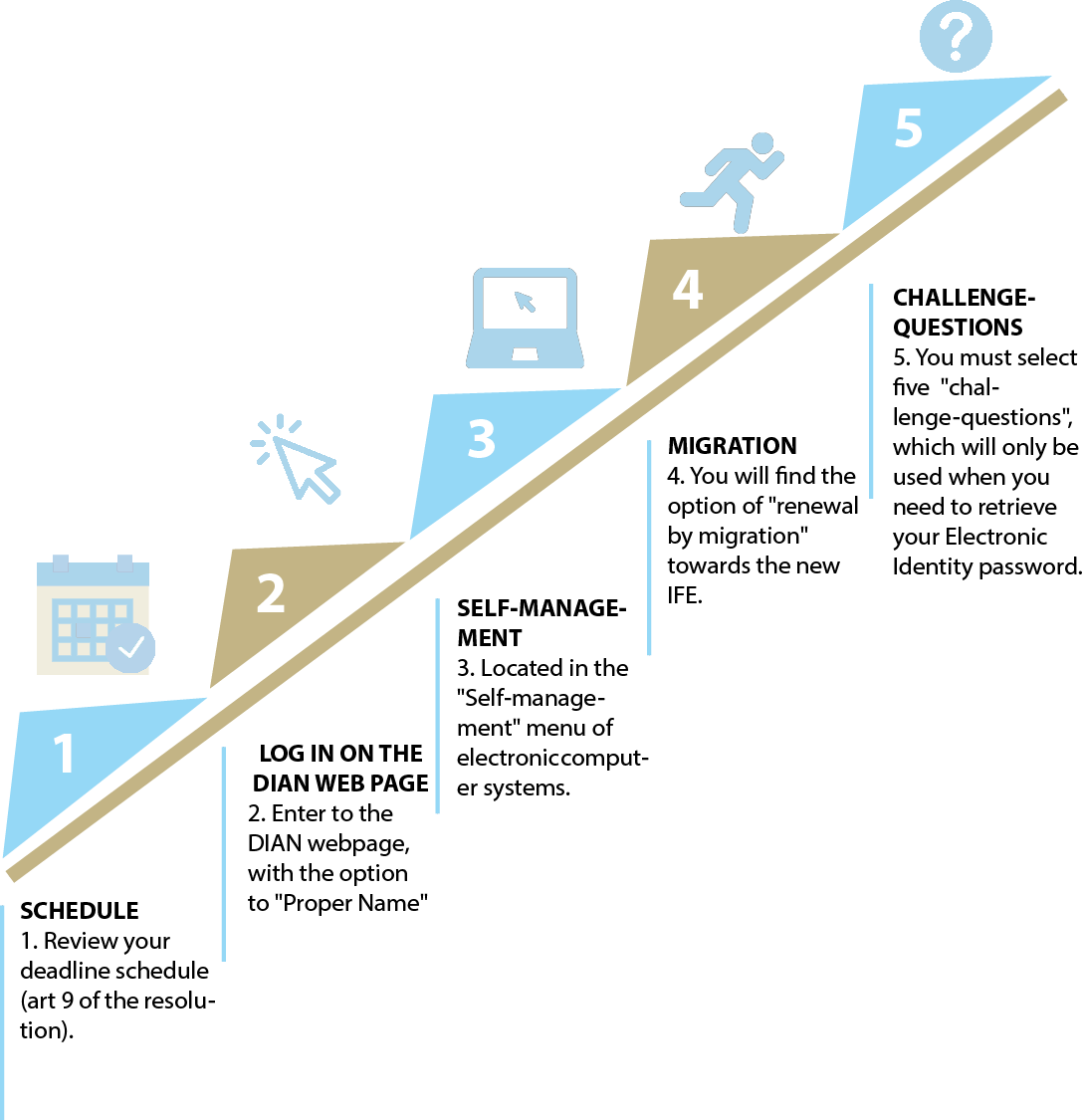

For those users who need to obtain their respective IFE for the first time, it will be necessary to go to the DIAN facilities in person. For “one time” the current holders of the digital signature mechanisms, backed by digital certificate, will be allowed to migrate virtually to the new IFE as follows:

Deadline: This migration must be carried out between 8 November 2016 and 30 June 2017. The schedule set forth in Article 9 of the Resolution is as follows:

- If the individual must sign tax returns and / or reports for one or more business entities classified as “Large Taxpayers”, in that case, and according to the last digit of the NIT of the entity, the migration took place between 8 November and 2 December, 2016.

- If the individual must sign tax returns and / or reports for one or several business entities that are not large taxpayers, in that case, and according to the last digit of the NIT of the entity, the migration will take place between 13 December 2016 and 31 March 2017.

- If the individual is only responsible for his/her own tax returns or tax reports, in that case, and according to the last digit of their NIT, the migration must take place in June 2017.

The Constitutional Court of Colombia has declared constitutional the Agreement between the Government of the Republic of Colombia and the Government of the French Republic to avoid double taxation

International Joint Ventures (2013)