Contracts for Difference (CFDs): an opportunity for the energy sector

By Gabriela Mancero for the Minas Petróleos & Energía Bar Association

In the Colombian context, Contracts for Difference (CFDs) can be a key tool for encouraging investment in renewable energy and stabilizing electricity prices.

Regulation of CFDs in Colombia

In financial terms, a Contract for Difference (CFD) is a financial derivatives contract. It can be entered into on a number of different products. The largest markets for CFD financial products are currency and interest rate swaps. In derivative contracts, the actual asset, in financial terms, the underlying asset, is not traded. The transaction is purely financial. In CFD contracts, an agreement is established between two parties to exchange payments based on the price of an underlying asset.

The Banco de la República de Colombia is the regulatory authority for foreign exchange matters. As such, it is responsible for supervising the Colombian cross-border derivatives market and the local derivatives market related to foreign exchange transactions. CFDs are generally defined as derivative products that allow investors to take a position on changes in the value of an underlying asset.

In Colombia, CFDs are atypical contracts, not regulated by law. Despite this nature, the Banco de la República has classified CFDs by interpretation as financial derivatives. Investments can be made with both local and foreign agents authorized as so-called authorized foreign agents or online dealers or market makers, as permitted by local regulations.

Foreign agents authorized to carry out derivative transactions with Colombian residents are those non-domiciled entities that have carried out such transactions in the immediately preceding year for a nominal value exceeding USD 1,000,000,000. Despite this requirement, Colombian residents, and not a government entity in Colombia, are responsible for properly assessing compliance with this requirement by foreign agents.

In derivative contracts, the actual asset, in financial terms: the underlying asset, is not traded. The transaction is purely financial.

In Colombia, CFDs can be used to provide stable long-term prices for renewable energy producers, protecting them from the volatility of the electricity market. These contracts allow producers to sell their energy at an agreed fixed price, while the State or a regulatory entity assumes the risk of market fluctuations. It is the movements in the price of the underlying asset that trigger payments between the parties to the contract without the actual asset changing hands, i.e., without physical delivery or transfer of ownership of the electricity. These transactions are carried out on margin, which involves the periodic delivery of money to the agent so that they can continue trading. CFDs can also be used to protect consumers from high electricity prices.

Here are some international examples of the successful use of CFDs in renewable energy:

- The United Kingdom has been a pioneer in the implementation of CFDs for renewable energy. In the latest round of auctions in 2017, two offshore wind projects were awarded CFD contracts at £57.50/MWh (€64.10/MWh), representing a 50% reduction in the costs of contracts awarded 30 months earlier.

- The European Commission has proposed a reform of the electricity market that includes the implementation of bidirectional CFDs for new renewable electricity projects and nuclear power plants. These contracts allow the state to compensate the producer if market prices fall below an agreed threshold and to capture the excess revenue if prices exceed that threshold.

- In Spain, CFDs are used as part of renewable energy auctions to ensure stable long-term prices for renewable energy producers. These contracts are awarded through competitive auctions, where producers bid the lowest price at which they are willing to sell their energy. These examples show how CFDs are increasingly seen as the preferred method for incentivizing investment in low-carbon projects and new technologies, leading to a two-way CFD model being the recommended market mechanism for contracts to be signed in the Colombia Offshore Wind Round led by the National Hydrocarbons Agency (ANH).

When designing CFDs, regulators typically pursue two broad objectives: first, to incentivize investment in renewables in line with the policy objectives of their development plans, and second, to integrate renewables into energy markets with as little distortion as possible. At the same time, the development of the energy system must follow the principles of security of supply and cost minimization. Contracts for Difference can play a crucial role in Colombia’s energy transition by providing price stability and encouraging investment in renewable energy. With an appropriate legal framework and transparent procedures, CFDs can help Colombia achieve its sustainability and energy security goals.

Crypto-asset regulation in colombia: recent trends

The regulation on crypto-assets is a relevant index to determine the digital business climate in a country. Like any emerging technology, its early adoption in a market and adequate regulation can be an important step in the digital transformation processes in companies, the government and support digital entrepreneurship. The efficiency and data decentralization of blockchain and cryptocurrencies generate disruptive effects in certain markets and may also create concern about eventual illegal activities deriving from the technology’s relative anonymity.

In Colombia, several public entities have issued regulation and opinions on crypto-assets. This is precisely the first trend that we want to highlight. In Colombia there is a diversity of public entities that have touched upon different legal issues related to crypto-assets, namely: financial, exchange, tax, commercial, compliance and contractual issues, among others.

The following is a list with the main existing regulation and opinions:

(a) Financial Superintendence, Chapter XVIII External Circular Letter No. 041 of 2015;

(b) Decree 2555 of 2010.

(c) Regulatory Decree 1068 of 2015 (article 2.17.2.4.1.1);

(d) External Resolution No. 8 of May 5, 2000;

(e) External Resolution No. 1 of May 25, 2018;

(f) External Circular Letter No. DODM-144 of September 14, 2018;

(g) External Circular Letter No. DECIP-83 of August 27, 2021;

(h) Central Bank Opinion No. JDS-03409 of February 16, 2011;

(i) Central Bank Opinion No. JDS-19704 of September 12, 2016;

(j) Central Bank Opinion No. C19-110904 of June 21, 2019;

(k) Central Bank Opinion No. C21-70969 Q21-4417 of December 9, 2021;

(l) Financial Superintendence Opinion No. 2020079520-001 of May 15, 2020.

This is an effect of the transversal use of crypto-assets in different economic sectors and for different activities. However, if greater legal certainty is sought, the government could adopt a public policy document defining the vision and direction of the relationship between the public and the private sectors in relation to these digital assets.

In general, the Colombian authorities agree on the following characteristics related to crypto-assets as a basis for their regulation in each legal field and to determine the risks of the crypto title-holders who trade these intangible assets:

- Crypto-assets are not currency, as the only monetary and account unit that constitutes a legal tender and means of payment with unlimited release power, is the Colombian peso issued by the Central Bank of Colombia (bills and coins);

- Crypto-assets are not money for legal purposes;

- Crypto-assets are not a currency, since it has not been recognized as a currency by any international monetary authority nor is it supported by central banks;

- Crypto-assets are not cash or cash equivalent;

- There is no obligation to receive crypto-assets as a means of payment;

- Crypto-assets are not financial assets or investment property in accounting terms;

- Crypto-assets are not securities, so their mention as such or assimilation should be avoided.

The above characteristics have been consistently upheld by different Colombian government documents and denote an interpretation of intangibles that is always based on traditional notions of assets.

Crypto-assets have been defined in Colombia as intangible assets and therefore are likely to be contributed to the capital of corporations, provided that (i) they comply with accounting laws and secondary rules and legal regulations; and (ii) that the partners approve their appraisal. Based on these arguments, the Colombian government expressly affirmed a change in its doctrine, confirming that shareholders can contribute crypto-assets in the form of a contribution in kind. The foregoing, subject to a series of requirements and recommendations, opens the possibility of incorporating crypto-assets as part of the incorporation of companies in Colombia.

Colombian residents who have crypto-assets as part of their assets must declare them in their annual income tax returns. The value for which they must be declared will be for their equity value, either as an intangible asset (investment) or inventory.

On the accounting side, it is recommended that a separate unit of account be created for the recognition, measurement and disclosure of transactions and other events or occurrences that are related to cryptocurrencies, which could well be called “crypto-assets” or “virtual assets”.

If the crypto-assets are traded in a foreign currency, the value of the assets in foreign currency is estimated in national currency at the time of their initial recognition at the official exchange rate, less credits or payments measured at the same official exchange rate of the initial recognition.

Colombian residents who have equipment, resources and work that are integrated into the crypto mining activity, allowing them to obtain virtual currencies in exchange for the services provided in the network and/or by way of commissions, receive taxable income in Colombia, by virtue of the aforementioned criteria. Likewise, it is clear that resident individuals and national companies are taxed not only on their income from a national source but also from a foreign source income and on their assets owned in the country and abroad. From the equity point of view, as long as these coins correspond to intangible assets, capable of being valued, they form part of the equity and can lead to the obtaining of (presumptive) income.

For instance, the purchase and sale of real estate with payment through crypto-assets is an exchange of an asset whose payment will be made through the delivery of an intangible asset. The tax obligations associated with income tax will be those derived from the execution of the exchange contract. Carrying out the exchange will affect the assets of the party delivering the crypto-asset; the payment of the price will generate an equity decrease due to its disposal. On the other hand, depending on the real estate valuation, seller may increase its assets by carrying out the respective exchange, or equate the equity value of the crypto-asset delivered. Consequently, the party delivering the crypto-asset must determine the equity value of said asset, and analyze whether, on the occasion of the exchange, an income for the difference between the tax cost of the asset and the value of its disposal was obtained. The payment of the property through crypto-assets may represent an increase in equity in the head of the property seller if the equity value of the crypto-asset is higher than that of the real estate. The capital increase must be reported in that party’s accounting and income tax return. To the same extent, the real estate seller must determine the equity value of said property, and verify if, on the occasion of the exchange, an income for the difference between the fiscal cost of the real estate and the value of the sale was obtained. The parties must comply with the provisions of the Colombian Tax Statute for the purpose of determining the minimum prices for the sale of the goods subject to the exchange.

As in other jurisdictions, Colombia is no exception for crypto-assets being used in criminal activities. Cases of criminal use, fraud and the use of crypto-assets for payments related to computer attacks and ransomware as well as for payments related to extortion are becoming more frequent. Crypto-assets can also be used as instruments for money laundering, terrorist financing and other criminal activities, in view of which the administrators of the companies that participate in the crypto-asset market must deploy: i) the maximum due diligence in the knowledge of the ends of the operation (including associates, employees, clients, contractors and suppliers, and their final beneficiaries), in regards to the prevention of ML/TF; and, ii) the diligence that a businessman in good faith would take into account to prevent the phenomenon of asset laundering or money from the public being illegally collected or any other damage to the public or private interest being generated through such company. Those who carry out operations with crypto-assets decide in a responsible, conscious and autonomous manner, at their own expense and risk, to assume the possible losses that could be derived from this type of transaction.

The difficulty of clearly defining crypto-assets has been used by criminals to deceive investors and to carry out illegal collection of funds and Ponzi schemes with business models and strategies that can only be carried out by financial entities authorized by the Colombian government.

The growth of the crypto-asset market, in particular cryptocurrencies, depends on the ability of crypto-assets being used in many activities. So, while there is need for a clear regulatory framework that allows measuring risks, it is also important that absolute prohibitions or regulatory disincentives disappear.

In the past two years, a bill that regulates the relationship between wallets, exchanges and platforms in relation to crypto assets has advanced for approval in the Colombian Congress. In the first place, this proposed legislation proposes a series of definitions, among others, the following:

- Wallets: These are the virtual media in which the public and private encryption keys are stored.

- Crypto-assets Exchange Services: these are the following services: (i) Administration of crypto-assets exchange platforms. (ii). Provision of custody and/or storage services for crypto assets. (iii). Exchange or transfer between crypto-assets and fiat currency, or between one or more crypto-assets. (iv). The supplementary or analogous services related to sections i, ii and iii above.

- Crypto Asset Exchange Platform (PIC): These are computer applications or interfaces, internet pages or any other means of electronic or digital communication through which the Crypto-asset Exchange Services are provided.

- Crypto-asset Exchange Service Provider: It is a national business entity or a branch of a foreign company, in charge of operating, managing and guaranteeing the operation of the PIC, registering with the Chamber of Commerce of its main domicile and responsible for compliance with the obligations.

- Unique Registry of Crypto-asset Exchange Platforms (RUPIC): It is an electronic public registry managed by the Chambers of Commerce whose objective is to allow anyone to access the information published in said registry, and to verify that the Service Providers of Crypto-assets Exchange as holders are duly registered.

- PIC Operations Manual: Document that contains the requirements and internal parameters of the PIC for the provision of Crypto-asset Exchange Services.

As a principle of interpretation of the crypto-asset market, it is established in the draft bill that crypto-assets are negotiable directly by their owners. The operation of the different crypto assets, their rules belong to the private sphere of the users, who, based on the principles of free market and free competition, must seek to be informed about the risks inherent in trading with assets of any kind.

The Crypto-asset Exchange Service Providers, Colombian or foreigners, must comply with the following requirements:

- Be incorporated as a commercial company domiciled in Colombia or as a branch of a foreign company, and be duly registered in the Colombian mercantile registry.

- Include as the exclusive corporate purpose the performance of activities classified as Crypto-asset Exchange Services.

- Establish and maintain a computer security program that ensures the availability and functionality of its computer systems, protecting said systems and all information stored in them, from unauthorized access, use and manipulation, the foregoing in accordance with the instructions that for this purpose imparted by the Ministry of Information Technology and Communications.

- Adopt control measures aimed at detecting and preventing money laundering and terrorist financing.

- Register in the Special Register for Crypto-assets Service Providers before the Chamber of Commerce of the entity’s main address, indicating the web domain and the information determined by the Ministry of Information and Communication Technologies.

- Report to the Financial Information and Analysis Unit the information that is required in compliance with money laundering regulations.

- Comply with the Colombian personal data protection regulations.

- Implement KYC and customer Due Diligence measures.

- Have an Operations Manual for the operation of the PICs that it manages, approved by the Ministry of Information Technologies and Communications.

According to the proposed bill, the Crypto-assets Exchange Service Providers are prohibited from:

- Offering or paying consumers interests or any other return or monetary benefit for the balance that they accumulate over time or maintain or for any operation directly or indirectly related to the exchange that they carry out with crypto-assets.

- Transferring under any title, lend or encumber crypto-assets or any other resource owned by consumers, stored by the Crypto-asset Exchange Service Provider, without the express authorization of the consumer.

- Developing any kinds of commercial network or multi-level marketing activity with crypto-assets, as well as their financial intermediation. Likewise, the administrators or service providers of crypto-asset exchange platforms may not allow the commercial distribution of crypto-assets to be carried out on their platforms through network or multi-level marketing activities or similar.

- Refraining from carrying out any conduct that leads to the massive and regular collection of funds from the public that additionally implies the absence of consideration in present or future goods or services that justify it or, even if such consideration exists, does not have a reasonable financial explanation.

The model proposed in this draft bill does not comprehensively regulate the different legal aspects of crypto assets. The relationship between some of the agents in the ecosystem can set aside a holistic vision that is necessary to obtain the benefits of intelligent regulation. It is not clear if the Financial Regulation Unit of the Colombian government agrees with the content of this bill.

To sum up, in Colombia there is a regulatory trend that has been transforming from a prohibition on the use of crypto-assets towards a vision more associated with the risks inherent in the market for these digital assets. The regulation remains disperse since different Colombian public entities with market supervision and surveillance functions have issued rules and opinions related to accounting, tax, contractual, exchange and financial issues, among others. An effective coordination between the different public entities that regulate crypto-assets is necessary to achieve legal certainty and stimulate the use of these digital assets as well as to generate a business environment that allows attracting investment. It is necessary to wait and see if the draft bill that is in progress becomes law so that wallets, exchanges and crypto-asset offering platforms in particular, are regulated more specifically in terms of their registration and duties as well as their liability towards consumers and users of crypto-assets.

New regulation on electronic payroll In Colombia

By: María del Pilar Duplat M. – Peña Mancero Abogados

The Colombian tax authority (DIAN by its Spanish acronym) issued resolution 13 of February 11, 2021 regulating the implementation of the electronic payroll system (the “Electronic Payroll Resolution” or the “Resolution”).

Who must submit the electronic payroll to DIAN?

Income taxpayers that are employers or that make payments due to legal or regulatory relationships or that make pension payments, and require to support said costs and deductions in their tax returns.

On a monthly basis, the aforementioned subjects must submit to DIAN a payroll supporting document for its approval or correction.

What is the payroll supporting document?

The electronic payroll supporting document is the document that shows all labor-related payments made by the employer. This document must contain the following information for its creation, transmission and approval by DIAN:

- Expressly indicate that it is an electronic payroll supporting document.

- Employer complete name of the individual or entity, ID Number or tax id number.

- Complete name(s) and ID of the person who receives the payment.

- The Unique Code Number of the Supporting Document of the electronic Payroll (CUNE by its initials in Spanish).

- Internal consecutive number granted by the subject obliged to submit the electronic payroll.

- Contents and amounts of the accrued value of payroll pursuant to the Technical Appendix to the Electronic Payroll Resolution.

- Contents and amounts of the deducted sums from the payroll pursuant to the Technical Appendix to the Electronic Payroll Resolution.

- Total amount resulting from the difference between the total accrued payroll payments minus the total deducted sums from the payroll payments.

- The contents of the Technical Appendix as provided in article 20 of the Electronic Payroll Resolution, regarding the information and contents contained herein.

- The form of payment of the payroll per the Technical Appendix to the Payroll Resolution.

- Date and time of creation of the document.

- Digital signature of the Subject who pays the Payroll in accordance with the DIAN’s requirements of authenticity and integrity of the signature.

- Complete name and ID or tax id number of the software supplier and identification of the software.

When do I have to submit the electronic payroll to DIAN?

The electronic payroll supporting document must be issued and sent to DIAN on a monthly basis, ten (10) days after its creation or issuance.

As of when must the electronic payroll be implemented?

- Implementation Calendar for subjects per the number of employees

| Group | Beginning date of the enabling of the electronic payroll data processing system | Maximum date to start the issuance and transmission of the electronic payroll payment support document and the electronic payroll payment support document adjustment notes. | Range in relation to the number of employees

|

|

| From | Until | |||

| 1 | May 31st, 2021 | July 01, 2021 | More than 251 | |

| 2 | August 01, 2021 | 101 | 250 | |

| 3 | September 01, 2021 | 11 | 100 | |

| 4 | October 01, 2021 | 4 | 10 | |

| 5 | November 01, 2021 | 2 | 3 | |

| 6 | December 01, 2021 | 1 | ||

- Permanent Implementation Calendar

The obliged subjects will have a term of two (2) months from the date in which they make the payroll payments to carry out the enabling of the service and proceeding to transmit the supporting documents of the electronic payroll and its adjustment notes.

The remaining subjects must issue the supporting payroll document and their adjustment notes to request the costs and deductions of the income tax and the VAT deductible taxes, when applicable.

- Implementation calendar for subjects not obliged to issue electronic sales invoices

Subjects not obliged to issue electronic sales invoices must start the enabling of the electronic data payroll service on March 31, 2022; and they must issue and send the supporting document of the payment of the electronic payroll and their adjustment notes, no later than May 31, 2022.

How do I issue the electronic payroll documents?

The enabling procedure is the one that is developed within the electronic invoicing system which must have the function to issue the electronic payroll supporting document pursuant to DIAN’s requirements.

The enabling procedure must be carried out before the date when the subjects must start with the implementation and the term when they must submit the monthly electronic payroll.

If you have further inquiries regarding this new regulation, please do not hesitate to contact us at: info@pmabogados.co

Why a due diligence process may become a nightmare in Colombia?

Strong institutions with reliable databases available to the public are key when carrying out a due diligence process. In most cases, information provided by the target is insufficient and not always accurate. This means that attorneys must be creative in order to look for the right information in the right places.

Here are some examples of what can go wrong if a due diligence process is not properly handled:

- Real estate is tricky in Colombia, especially when you acquire assets or companies with rural real estate. Many attorneys focus on making sure that the “owner” of the land or property is duly recorded with the Real Estate Registry without realizing there is so much more! For instance: (i) determining whether the area has oil & gas or mining licenses that would create compulsory easements or eventually hinder its use; (ii) determining whether there are environmental restrictions such as being part of a national park, a protected wetland or a forest; (iii) verifying whether the land was formerly owned by communities or people who had to give it up because of armed groups’ pressure and are now subject to restitution proceedings; (iv) confirming that the land is not in fact a barren land that someone occupied as, regardless of time lapsed, it will continue to be State-owned and not subject to transfer.

- The Superintendence of Corporations recently issued a new regulation introducing stricter rules for anti-money laundering and terrorism financing. We cannot hide that Colombia has individuals and companies involved in such activities that do business in creative manners so as to disguise the true origin of their funds. A proper investigation during due diligence should include examining who the beneficial owners of the target are and searching not only the standard international OFAC and similar lists but also carrying out a full search of local media publications and other more informal sources of information.

- Latin American countries keep facing more and more corruption scandals. Colombia is not the exception. Doing business with relatives, partners and close friends of politically exposed parties can be risky. A proper due diligence should involve requesting full disclosure not only from all sellers but also from the target’s main stakeholders. Regulatory standards can be found in the Colombian anti-corruption statute.

- Unlike most Latin American countries, Colombia’s foreign exchange regulation imposes strict reporting obligations concerning foreign-currency-related operations such as foreign investment, receiving or granting loans from/to foreign residents, granting securities abroad, imports and exports. Non-compliance with such obligations may derive in huge fines to be imposed either by the Superintendence of Corporations or by the tax authority (DIAN). To avoid such liability, due diligence should include reviewing all the above foreign exchange transactions including: timely filing of reports to the Central Bank; correct reporting of each transaction; requesting an up-to-date report from the Central Bank to obtain information on all reported items.

- When searching for the history of land, corporations, litigation, property and any other asset that is subject to public record, one must be careful in Colombia. Government agencies are not always up-to-date and technology tends to be basic when it comes to search engines. There are entities and courts who simply do not provide such service to the public so not being able to complete an independent verification of the target’s records is common.

Being able to distinguish between what a “deal breaker” is and what not requires a thorough understanding of the risks involved and their eventual effects. For example, if a mining license does exist on the target’s land, a deal breaker would be not being able to use the land at all because of a compulsory easement that would prevent you from carrying out any activity whatsoever and that land being essential and of great value to the business you are acquiring. Otherwise, you may still negotiate such liability being properly disclosed in the “Disclosure Schedule” of the purchase agreement and establishing an escrow or taking any other measure to tackle loss if occurring. The same thing cannot be said when there are findings concerning money laundering or corruption charges. The risk involved in such situations would need to be measured in a very conservative manner as effects would not only involve economic consequences but eventual imprisonment.

Peña Mancero Abogados is publishing a series of high-level articles on M&A activity in Colombia. This article is for information purposes only and does not constitute legal advice. If you require further information, please contact Gabriela Mancero (info@pmabogados.co)

Guidelines for the treatment of personal data in artificial intelligence

By: María del Pilar Duplat – Peña Mancero Abogados

In June 2019, the Superintendence of Industry and Commerce (hereinafter “SIC”) issued its Guidelines for the treatment of personal data through Artificial Intelligence (AI).

- Purpose of the Guidelines

The guidelines seek to provide a series of suggestions to those who develop artificial intelligence projects based on the Standards for Data Protection for the Iberoamerican States of the Ibero-American Data Protection Network (RIPD, after its acronym in Spanish).

- Recommendations

- To comply with local regulation on the treatment of personal data

To avoid any legal objection over the AI products, it is important that your organization develop from the beginning a legal risk study of the local regulations to determine a strategy to:

- Mitigate legal risks.

- Earn and maintain the trust of the users of the AI technologies.

- Prevent any damage to the reputation of the organization.

- Avoid potential investigations from data protection or other authorities.

- To develop privacy impact studies

Before designing and developing AI products and to the extent possible, if there is a high risk of affecting the data protection rights of the owners of the data, it is necessary to develop a Privacy Impact Assessment (PIA) to put in place an effective system of risk management and internal controls to guarantee that the data is dully treated and in compliance with the current regulation.

Said PIA must contain at least the following:

- A detailed description of the operations of treatment of personal data involved in the development of the AI.

- An evaluation of the specific risks for the rights and liberties of the owners of the personal data.

- The measures foreseen to face the risks, including the guarantees, safety measures, software design, technologies and mechanisms that guarantee the protection of the personal data, taking into consideration the legitimate interests and rights of the owners of the data and other potentially affected third parties.

The results of the PIA with the risk mitigation measures are part of the principle of privacy by design and by default.

- To include the privacy, ethics and security from the design and by default

The privacy by design and by default is considered as a proactive measure towards the Principle of Accountability. By including the privacy from the design, the organization seeks to guarantee the adequate treatment of the personal data used in the AI procedures, even before the risks are materialized.

Thus, the privacy by design must be included in the design, the architecture of the software or the algorithm of the AI product. The following are the purposes that the technology must include:

- Avoid unauthorized access to the data.

- Avoid the manipulation of the data.

- Avoid the destruction of the information.

- Avoid unauthorized or improper uses of the information.

- Avoid the circulation or supply of the data to unauthorized people.

The safety measures must be adequate and must consider various risk factors, such as:

- The risk levels of the treatment of data for the exercise of the rights and freedoms of the owners of the data.

- The nature of the data.

- The potential consequences derived from a safety breach and the magnitude of the damage caused by said breach to the owner and, overall, to the society.

- The number of owners of the data and the amount of information.

- The size of the organization.

- The available resources.

- The monitoring and follow-up of the reliability of the algorithms.

- The status of the technique

- The reach, context and purposes of the treatment of the information.

- The cross-border circulation of the data.

- The uncertainty and complexity of each AI initiative.

- Every safety measure must be revised, evaluated and permanently improved.

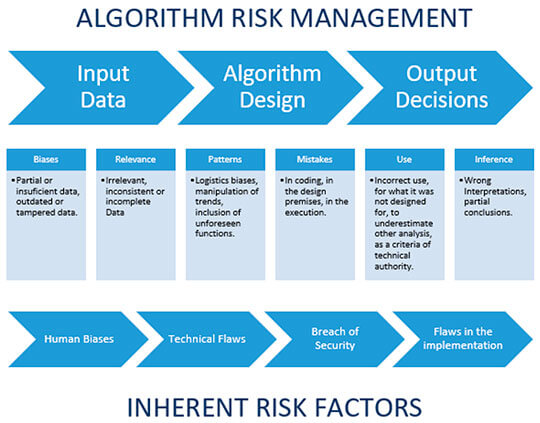

The following are risk management aspects that have an impact on the algorithms:

- To materialize the principle of accountability

The designers and developers of AI products must adopt useful, appropriate and affective measures to comply with their legal obligations. They must also show the evidence of the correct compliance of their duties. Said tools must be subject to permanent revision and evaluation to determine their effectiveness regarding the compliance and degree of protection of the personal data.

For said purpose, and to comply with the principle of accountability, the organization should have, at least the following:

- Allocate resources to implement data protection programs and policies.

- Implement a risk management program for the treatment of data protection.

- Develop mandatory data protection programs and policies within the organization.

- Put in place training and updating programs for the personnel on the obligations of data protection.

- Review periodically the policies and programs for the safety of the data to determine the required amendments.

- Incorporate an internal and external surveillance system, including audits, to verify the compliance of the data protection programs and policies.

- Establish procedures to receive and answer questions and complaints of the owners of the data.

The accountability principle goes further than just creating a series or policies and programs, it requires that the organization responsible for the treatment of the data can show evidence of concrete results of the correct treatment of the personal data in the AI projects.

- To design adequate governance schemes over the treatment of personal data in the entities who develop AI products.

It is recommended that the organization defines a structure with clear functions and responsibilities that guarantee a proper corporate governance for the respectful treatment of the norms related to the personal data protection regime and the rights of the owners of the data.

The main functions and responsibilities that must be set within the organization are the following:

-

- Develop risk management evaluations.

- Decide which decision-taking models will be used.

- Develop maintenance, monitoring and revision activities.

- Review the channels of communication with the users and consumers.

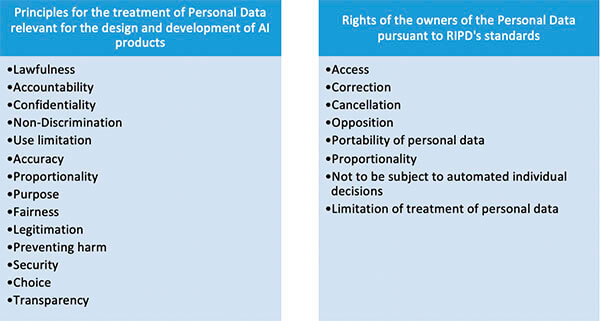

- To undertake measures to guarantee the principles of data protection in the AI Projects

Every person or organization responsible or in charge of the treatment of personal data must foresee adequate and efficient strategies to guarantee the compliance of the principles of treatment of personal data pursuant to the principles of the Standards for Data Protection for the Ibero-American States of the RIPD.

- To respect the rights of the owners and implement effective mechanisms so they can exercise them.

The organizations that create or use AI technologies must guarantee the following rights to the owners of the personal data:

It is specially important to talk about the right “not to be subject to automated individual decisions” when we talk about AI proyects. Thus, when talking about AI projects, it must be a possibility for the owners of the personal data to argue any decision related to the treatment of his/her personal data before a human being, and that it is not 100% in charge of algorithms or automated procedures.

Additionally, the RIPD’s Standards forbid that the automated decisions are discriminatory. Thus, developers of the AI proyects must foresee in their design all the mechanisms or options for the owners of the data to exercise their rights through simple, free, fast, and accesible means that allow them to access, rectify, cancell, opose or transfer their personal data.

- To ensure the quality of the data

One of the risks using AI is that the machine is biased due to the configuration of the algorithm and the quality of the information. To minimize the risk of bias and prevent the breach of the rights of the owners of the personal data, it is suggested that:

- The information used by the AI is true and precise.

- The organization carries a registration of the source of the data.

- The organization makes audits of the sets of data used in the creation of the algorithms used in the decision-making processes by the machine.

- Grant veracity scores to the sets of data used to train the machine during its creation.

- Regularly update the data.

- Have separate sets of data to train, prove, and validate the decision-making processes.

- To use anonymization tools

It is important to determine if it is strictly necessary that the information that will be used by the AI must be used or linked to a person. If it is not necessary it is recommended that the information is used anonymously, so the owner of the data is not identified. In this way, the anonymization will help in the mitigation of the risks of massive treatment of personal data in the AI projects and procedures.

- To increase the trust and transparency with the owners of the personal data

A transparent organization may increase the trust of the owners of the Data in it through:

-

- Keeping open communication channels with Data owners and disclosing its policy for the treatment of the personal data in AI procedures or products. It is important to use a simple language that a non-expert in AI may understand.

- Carrying out pilot tests to evaluate the decision-making model and correct any problem that may exist.

- Giving the option to the data owner, in certain cases, that its information is excluded from the data provided and studied by the machine in the development of the algorithms and patterns in the cases allowed by law.

- Implementing revision channels so the decisions taken by the machine may be revised by humans to ratify them or correct them.

Why is Big Data so important for the evidence in the judicial and arbitral proceedings?

- Título: Why is Big Data so important for the evidence in the judicial and arbitral proceedings?

- Fecha de publicación: may. de 2018

- Descripción de la publicación: Blog del Departamento de Derecho de los Negocios de la Universidad Externado de Colombia

- Autor: Daniel Peña

Mining Law 2017

- Título: Mining Law 2017

- Fecha de publicación: 2017

- Descripción de la publicación: The ICLG to: Mining Law covers common issues in mining laws and regulations – including the mechanics of acquisition of rights, foreign ownership and indigenous ownership requirements and restrictions, processing and beneficiation, transfer and encumbrance – in 32 jurisdictions.

- Editorial: GLOBAL LEGAL GROUP

- Autor: Gabriela Mancero

Landmark draft bill to change the Colombian alcohol industry monopoly