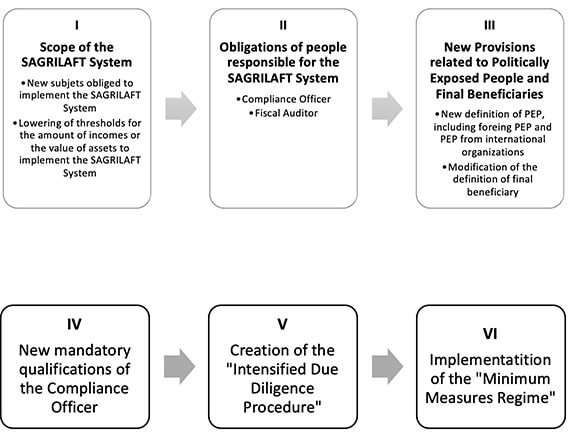

New provisions related to the prevention of money laundering, financing of terrorism and financing of the proliferation of mass destruction weapons

At Peña Mancero we consider of the outmost importance to keep our clients updated on the latest regulations which are relevant to their activities. Hence, we would like to inform you that the Superintendence of Companies on December 24 of 2020 issued the External Circular 100-000016 pursuant to which it amended the chapter 10 of the Basic Legal Circular which refers to the Self-control and management of the risk of money laundering and financing of terrorism and the report of suspicious transactions to the UIAF. Please find hereunder the summary of the aforementioned changes:

Please find below more detailed information regarding these modifications:

I- Scope

1- Obligation of the Companies, branches of foreign companies and sole owner companies to implement the System of Self-Control and Integral Risk Management of Money Laundering (LA by its initials in Spanish), Financing of Terrorism (FT) and Financing of the Proliferation of Mass Destruction Weapons (FPADM) (SAGRILAFT by its initials in Spanish)

By May 31st of 2021, the following companies monitored by the Superintendence of Companies must implement the SAGRILAFT system:

a) Real Estate Agents:

It is no longer required that the companies dedicated to real estate activities receive their main income from this specific economic activity; now, it is enough:

- For the social purpose of these companies to foresee that they may develop real estate activities and that they carry out transactions pursuant to said activity for an amount of 100 minimum monthly legal wages (MMLW) (COP $90.852.600 for 2021) or higher in the calendar year of the latest year; or

- That as of December 31st of the immediately preceding year, the Company has received total income equal or higher than 30.000 MMLW (COP $27.255.780.000).

b) All companies regularly dedicated to the trading of metals and precious stones (and not only the ones dedicated to the exploitation of mines and quarries), that, as of December 31st of the immediately preceding year, have had an income equivalent or higher than 30.000 MMLW (COP $27.255.780.000).

c) Legal Services (the regulation is the same as before).

d) Accounting Services: it is restricted only to those companies whose regular activity is identified with the CIIU code 6920. The level of yearly income for these companies is the same as before.

e) Vehicles, their parts, pieces and accessories are not obligated to implement the SAGRILAFT system.

f) Construction of buildings and civil engineering activities. The companies who develop the activities identified with the CIIU codes F4111, F4112, F4210, F4220 o F4290 must implement the SAGRILAFT system. Additionally, these companies must implement the SAGRILAFT system when as of December 31st of the immediately preceding year, have received a total income equal or higher than 30.000 MMLW (COP $27.255.780.000).

g) The following companies who develop activities with an income equal or higher than 100 MMLW (COP $90.852.600) and that as of December 31st of the latest year have received an income equal or superior than 3.000 MMLW (COP$2.725.578.000) or that have had Assets equal or of more than 5.000 MMLW (COP$4.542.630.000), are now obliged to comply with the SAGRILAFT system:

- Exchange of Virtual Assets and fiat coins;

- Exchange between one or more forms of virtual assets;

- Transference of virtual assets;

- Custody or administration of virtual assets or instruments that allow the control over virtual assets.

- Participation and supply of financial services related to the offer from an issuer or the sale of a Virtual Asset, and

- Overall, services related to virtual assets.

h) Companies who as of December 31st of the immediately previous year have received contributions in virtual assets.

2- Any other sector whose companies are monitored by the Superintendence of Companies that as of December 31st of 2020 have income or total assets equal or higher than 40.000 MMLW (COP$36.341.040.000)

People responsible for the SAGRILAFT system within the Company

The new regulation assigns specific functions within the system to the compliance officer, the legal representative and the board of directors or maximum corporate organ of the company, the latter will be the one responsible for the implementation and effectiveness of the SAGRILAFT system. The new regulation also assigns specific functions to the person in charge of guaranteeing the technical, logistical and human resources for the implementation and for maintaining such system in operation, among other measures. Additionally, the companies may incorporate other organs or additional positions in charge of the evaluation of the compliance and the effectiveness of the SAGRILAFT.

The Fiscal Auditor has the duty to report the crimes, breaches and disciplinary offences of which it has knowledge. To comply with this duty in the analysis of the accounting and financial information, the Auditor must pay attention to the data that may be suspicious of an act related to a potential activity of money laundering, financing of terrorism or financing of the proliferation of mass destruction weapons.

New provisions

The circular modified the definition of final beneficiary and politically exposed people (PEP), also it included the notion of foreign PEP.

For the purposes of the new regulation, PEP is anyone who is a public officer from any system or public administration employment (local or national), when the functions of the position that they hold or the functions of the area to which they belong or in the positions that they hold include under their direct responsibility or through delegation, the general direction, the issuance of institutional policies and the adoption of plans, programs and projects, the direct management of assets, public resources or titles of the State. These may be through the ordering of public expenses, public procurement processes, investment management projects, payments, liquidations, administration of movable or immovable assets. It also includes foreign PEP and PEP from International Organizations.

Compliance Officer

It is now a requirement that the compliance officer has sufficient knowledge related to risk management and must also understand the ordinary activities of the company.

Intensified Due Diligence

The new regulation includes the concept of intensified due diligence which implies the advanced knowledge of the counterparty and of the origin of the received assets, which includes additional activities to the ones carried out in regular due diligence procedures.

Minimum measures regime

The new regulation incorporates a new concept, the “Minimum Measures Regime” which will be applicable to the enterprises who develop designated non-financial activities and professions (APNFD), within the following sectors, provided that as of December 31st of the previous year, they have obtained an income equivalent or superior that 3.000 MMLW (COP$ 2.725.578) or have assets of 5.000 MMLW (COP$ 4.542.630.000) or more:

- Real Estate

- Trading of metals and precious stones

- Accounting services

- Legal services

For more information please find attached hereto the External Circular 100-000016 of December 24 of 2020.

Resolution No. 532 of 2024 UGPP: Establishing a Cost Assumption Scheme for Self-employed Workers and Those Who Enter Contracts

Data Protection & Privacy