How to succeed with Temporary Import to Colombia through leasing?

This article presents the possibilities and strategies available under Colombian law for the import of equipment. For the purposes of our analysis, we shall take as example the import of equipment aimed at providing a temporary power plant in Colombia (the “Project”).

The Project consists of the import of equipment in order to assemble a temporary independent power plant in Colombia. In order to acquire and import the equipment, the importer executes a leasing agreement which involves a purchase option. This means that the importation could be temporary –only for the life of the Project (five years) – or definitive, if the purchase option is exercised.

If the import turns out to be temporary, the importer will export the equipment abroad after finishing the Project.

The article analyzes the following main topics: import process under Colombian law, including the temporary import; leasing agreements as an importation tool and the use of the special customs regime created for that specific case.

The import process in Colombia

The import process implies the compliance of customs obligations, formalities and responsibilities derived from the regulations and the acts of the customs authority, such as payment of duties, taxes, interest, fees, surcharges and penalties, where applicable.

In accordance with the above, the importation process will require the submission of information and documents and the compliance of responsibilities, previously or at the arrival of the merchandise. Specifically, among others, will be necessary:

- The exhibition of the merchandise before to the customs authority

- The filling and submission of the customs declaration

- The payment of the duties, interest and taxes caused by the importation

- Obtaining and keeping the documents that support the operation

- Submitting the operation documents when required by the customs authority

- Answering the information and evidence requests

- In general, complying with the requirements and conditions established in the corresponding regulations.

The information related to the operation that has originated the importation must be submitted through electronic means prior to the shipping of the equipment. The omission of this obligation does not constitute an infringement, however, the operation may be classified as a high risk operation for the purpose of customs controls.

The importer must fill and submit the customs declaration, including a tariff heading and must apply to the imported goods a specific customs regime.

Tariff heading

The tariff heading is a classification which consists of a 10 digit code which internationally identifies the goods. There is a unique code for every product, these codes are listed in the Colombian Tariff List which is available to be consulted in the Colombian Customs Authority’s web site.

The tariff heading allows to know the specific aspects, requirements and characteristics of the importation, such as approvals or preliminary permissions that shall be obtained as support for the customs declaration.

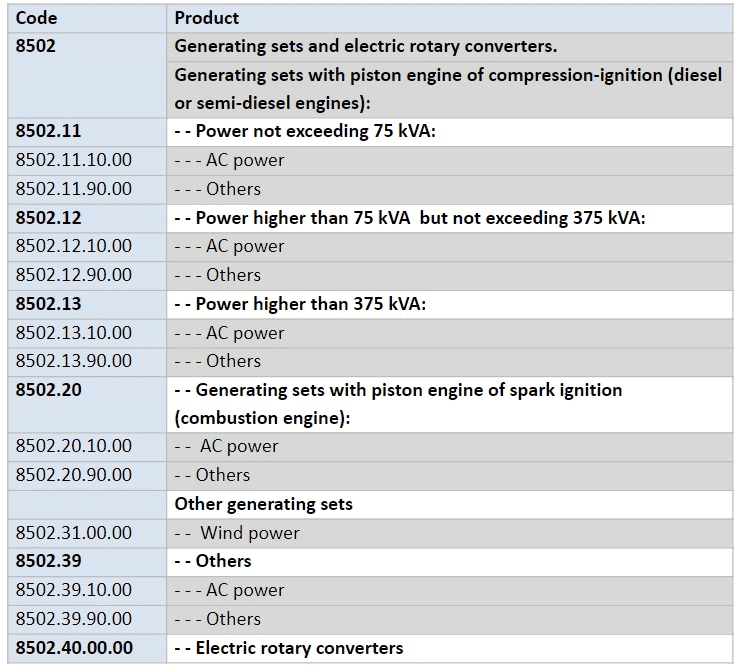

In our example, the power plant equipment may be classified in one of the following tariff headings:

| Code | Product |

| 8502 | Generating sets and electric rotary converters. |

| Generating sets with piston engine of compression-ignition (diesel or semi-diesel engines): | |

| 8502.11 | – – Power not exceeding 75 kVA: |

| 8502.11.10.00 | – – – AC power |

| 8502.11.90.00 | – – – Others |

| 8502.12 | – – Power higher than 75 kVA but not exceeding 375 kVA: |

| 8502.12.10.00 | – – – AC power |

| 8502.12.90.00 | – – – Others |

| 8502.13 | – – Power higher than 375 kVA: |

| 8502.13.10.00 | – – – AC power |

| 8502.13.90.00 | – – – Others |

| 8502.20 | – – Generating sets with piston engine of spark ignition (combustion engine): |

| 8502.20.10.00 | – – AC power |

| 8502.20.90.00 | – – Others |

| Other generating sets | |

| 8502.31.00.00 | – – Wind power |

| 8502.39 | – – Others |

| 8502.39.10.00 | – – – AC power |

| 8502.39.90.00 | – – – Others |

| 8502.40.00.00 | – – Electric rotary converters |

Customs regime

The customs regime is chosen depending on how the operation is performed. The customs regime is a special treatment ruled by the customs regulations applied to the merchandise that enters or leaves the national territory. The customs regime, in importations, could be mainly one of the following:

Definitive importation:

- Importation for consumption

- Franchise importation or taxes and fees exemption

Suspensive regimes:

- Temporary admission for re-exportation in the same condition.

- Temporary admission for active improvement.

Transformation and/or assembly.

Special importation regimes:

- Temporary importation of rented goods or goods acquired by leasing agreement (with purchase option).

For our purposes, taking into account the description of the Project, the applicable customs regime will be the special regime of temporary importation of rented goods or goods acquired by a leasing agreement (4a).

Leasing agreements as an import tool in Colombia

The leasing agreement is a contract whereby certain goods, acquired by the leasing company (the lessor), are given in lease to the lessee, financing their use in exchange of a periodic fee that must be paid throughout a certain term. The lessee shall have a purchase option that could be used at the end of the settled period.

The lessor, who in Colombia may be a duly authorized commercial financing company supervised by the Financial Superintendence, must necessarily have the property of the mentioned goods until the purchase option is used.

It is also permitted that the Colombian leasing companies may accept leased goods from foreign leasing companies in order to be subleased to Colombian residents (subleasing). In this cases the Colombian leasing companies shall be expressly authorized by the foreign lessor to sublease the goods.

Likewise it is possible in Colombia that several leasing companies could jointly lease goods of which they are co-owners.

Special customs regime for temporary importation of goods acquired through a leasing agreement.

The Colombian customs regime has implemented a special importation regime regarding the temporary importation of goods through leasing operations. This special regime allows to bring goods into the national customs territory – TAN (for its acronym in Spanish) with a deferred payment of the importation fees and taxes.

This regime applies to those goods imported under a leasing agreement -with purchase option-, which are intended to be re-exported within a certain term, without undergoing any modification, and admitting only the regular depreciation derived from the ordinary use of the imported goods. The goods imported under this regime are not considered as a free circulation merchandise. More details about Temporary Importation confirmed by US Agency.

The leasing agreement constitutes the supporting document to the customs declaration.

In this scenario the limit period for the temporary importation will be the term of validity of the leasing agreement. This term could be extended as the parties agree in the contract as long as the guarantee is renewed, presented and accepted. The term in which the goods will remain in the TAN must be declared in the customs declaration.

As said, the application of this special regime will require the establishment of a guarantee equal to one hundred percent (100%) of the liquidated importation rates and taxes, and must have as its insurable purpose the payment of the duties, taxes, penalties and interests that may arise as a consequence of the breach of the importer’s obligations and responsibilities.

If the duration of the leasing agreement is over five years, the guarantee shall be established ensuring the compliance, at the expiration of the fifth year, of the payment of the importation duties and taxes, sanctions and interests that may arise as well as the termination of the special regime.

When the term of five years expires and the guarantee is extended, the amount in the renewal will be equivalent to the sanction for the non-termination of the special regime.

This special customs regime may terminate with:

- The exportation of the goods;

- The importation for consumption or by franchise when applicable

- The destruction of the goods.

Likewise, as a penalty, the non-compliance with the payment of two successive installments will imply that the customs authority may declare the termination of the special regime.

In order to re-export the goods under this regime, the importer must have complied with all the corresponding payments and installments of the deferred payment during the time the goods remained in the TAN.

If the goods were destroyed, all the remains with some commercial value shall be submitted under the consumption importation regime and to the payment of the corresponding taxes and rates.

Otherwise, when the five-year-period is completed and the purchase option is exercised, the importer will have one month since the date of exercise of the purchase option to terminate the regime through the importation for consumption or by franchise without losing the deferred payment benefits.

This special customs regime can be modified to consuming or franchise importation. For this, the importer must submit the register or importation license along with the initial declaration.

For more details, please have a look on the Guide realized by ProColombia (Colombian government agency in charge of promoting Colombian non-traditional exports and foreign investment)

Conclusion

The import regulation in Colombia, allows the importation of equipment through the compliance of several requirements and formalities, within which the submission of the customs declaration, the inclusion of the tariff heading and the selection of the custom regime are key. Such specifications will define the specific requirements of the importation, such as approvals, preliminary permissions, payment of duties, taxes, interest, fees and surcharges.

Leasing agreements may be a useful tool for the import of equipment which allows the deferred payment of the importation fees and taxes (during the first 5 years) while permitting its exportation if the option is not exercised. The downside is that this special regime requires the establishment of a guarantee equal to the one hundred percent (100%) of the liquidated importation rates and taxes.

Colombia is a leader in the fight against transnational bribery

International Joint Ventures (2013)